If you’re planning to start a new business, then choosing the business structure is one of the most important decisions you’ll make.

While each entity offers unique advantages or disadvantages, many entrepreneurs make the choice based on the tax implications of an entity.

If you want to understand the role of taxes in choosing the right business structure, then this post is for you.

You will learn about the common business structures and the tax considerations for each. So, keep reading to learn more.

Common Business Structures and Their Tax Implications

Here, I’ll cover four common business structures and how they’re taxed. This will help you understand the role of taxes and help you choose the right business structure.

1. Sole Proprietorship

This is the most basic structure that’s best for single-owner startups or small businesses. It offers you complete control over your business, but you’re also liable for its debts and liabilities.

Type of Taxation

Sole proprietorships have pass-through taxation by default. As such, the company doesn’t need to pay any taxes, but the owner will be taxed on their income from the company and other sources.

Key Tax Considerations

- Taxation is simple and you won’t need to do anything other than what you would normally do—file annual personal income tax returns.

- However, the personal tax rates could be high if you earn a significant income from your business.

- You will also need to pay a self-employment tax

- Also, you will need to pay employment taxes if you hire employees.

2. Partnership

If you plan to start a business with one or a few partners or co-owners, then this is a good option. It’s similar to a sole proprietorship, except with multiple owners.

Type of Taxation

It also has pass-through taxation, similar to sole proprietorships. The partners pay income taxes on their share of the profits from the partnership.

Key Tax Considerations

- It also has simple taxation that requires minimal effort, so you can manage taxes yourself.

- You will also need to pay a self-employment tax on your income and employment taxes on employees’s incomes.

3. Limited Liability Company

LLCs provide management flexibility of sole proprietorships and partnerships with the liability protection of corporations. They’re great for small and mid-sized growing businesses. As GovDocFiling experts say, You can register an LLC with the help of a professional consultant or agency.

You can learn more about the process of registering an LLC check out this article.

Type of Taxation

By default, LLCs enjoy pass-through taxation. However, you can choose for your LLC to be taxed as a corporation as well. This tax flexibility is unique to LLCs, and you won’t get this with any other entity.

Key Tax Considerations

- Your LLC will be taxed differently depending on your preference. You can choose to be taxed in a way that maximizes tax savings.

- If you forego the pass-through taxation, tax preparation and filing will become more complex.

- Opting for an S-corp tax status would need additional paperwork, but could lead to major tax savings for your business.

4. C-Corporation

If you plan to form a business and expand it to multiple states, then you should consider a C-corp. Whether you want to run an online business or a physical business with multiple locations, this is the best entity for that.

However, forming a C-corp is more difficult than forming any other business entity. You may need external help for filing. You may also need to hire a bookkeeper or accountant once you establish your business.

You may also need to create a financial report and submit it annually to the state authorities.

Overall, it’s the most formal business structure and best for expansion as you can raise capital by issuing stock.

Type of Taxation

Corporations need to pay corporate taxes on their profits and employment taxes for employees. The shareholders will also pay income taxes on their income and dividends from the company.

Depending on the type of business, you may also need to pay excise taxes.

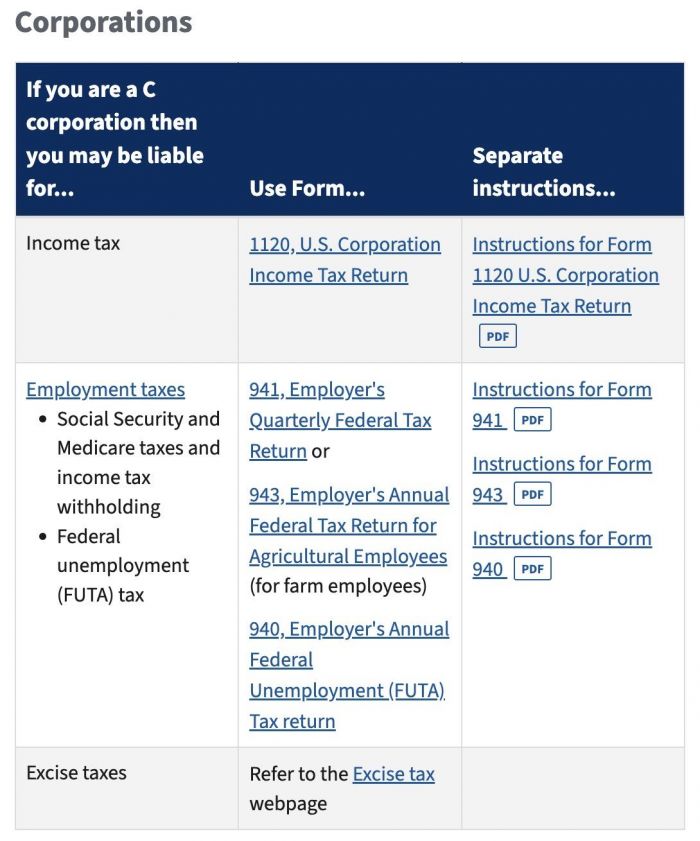

Here’s a table by the IRS that summarizes the tax obligations of corporations.

Key Tax Considerations

- One of the biggest drawbacks of this entity is double taxation as both the company and the owners pay taxes on their income.

- However, you also avoid paying a self-employed tax, so that counters the negative.

- Moreover, you can write off many business expenses and effectively reduce your company’s taxable income.

- Overall, even if the taxes may be slightly higher than what you’d pay for other entities, there are enough benefits to choose a C-corporation.

- After you form a corporation, you can also apply for the special S-corp tax status to get some tax advantages. However, this will also put some restrictions on the number and type of shares you can issue and who the shareholders can be.

Ready to Choose the Right Business Structure to Maximize Tax Benefits?

The business structure you choose affects how much taxes you pay, what forms you need to file, and many other things. There are lasting financial implications for your business if you choose the wrong structure.

That’s why it’s important to understand the role of taxes in choosing the right business structure.

Hopefully, this article will have provided you with some clarity on the matter. Understand the tax considerations of choosing each business structure and then make a choice that gives you the most benefits.

Once you start your business, don’t forget to create a stellar marketing strategy to grow it.

Post Comment

Be the first to post comment!