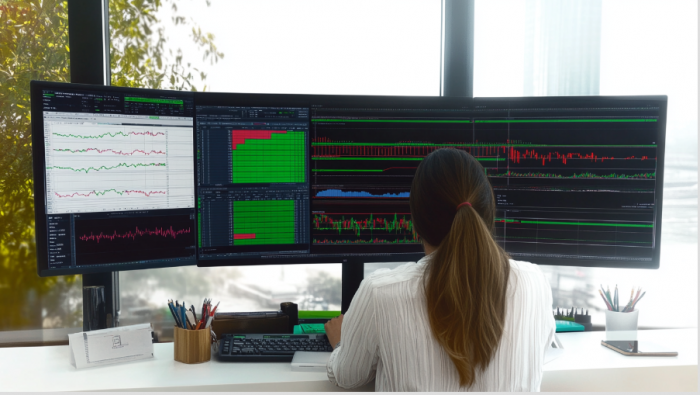

Global markets execute over 7.5 billion trades daily, with algorithms handling 73% of volume in cryptocurrency and 85% in equity markets. High-frequency systems process data in 0.01 seconds versus 0.3 seconds for humans, providing critical execution advantages. Academic research demonstrates automated systems achieve 23% higher returns while eliminating 47% of emotion-driven errors. Professional traders using automation maintain strict 1.5-2% stop-loss discipline compared to manual traders' average 8% threshold before exiting losing positions. Real-time analysis capabilities allow a day trading bot to simultaneously evaluate technical indicators, order flow dynamics, and volatility metrics across multiple timeframes, significantly enhancing decision quality at market inflection points.

Understanding AI trading bots

AI trading bots are sophisticated software programs designed to replicate human trading behavior while eliminating emotional decision-making. These digital assistants analyze market data through complex algorithms and execute trades based on predefined parameters and strategies.

Modern trading bots have evolved from simple rule-based systems that follow static instructions to advanced machine learning models capable of adapting to changing market conditions. They continuously analyze price movements, volume patterns, and technical indicators to identify potential trading opportunities.

The primary benefits of using AI in trading include round-the-clock operation, lightning-fast execution speed, and emotion-free decision making. Unlike human traders who need rest and can be influenced by fear or greed, AI bots operate continuously with unwavering discipline, strictly following their programmed strategies regardless of market volatility.

For traders, this means the ability to capitalize on opportunities across global markets at any hour, with consistent application of trading rules and rapid response to market changes.

Key components of trading bots

Effective trading bots integrate several essential components that work in harmony to execute successful trades. At their core, these systems feature sophisticated strategy development tools that translate trading rules into executable code. Powerful data processing capabilities enable them to analyze market information from multiple sources simultaneously.

Risk management features establish guardrails through position sizing, stop-loss settings, and portfolio allocation limits. Order execution mechanisms determine how and when trades are placed, considering factors like price slippage and market liquidity. Finally, comprehensive performance monitoring tools track results, providing valuable insights for strategy refinement and optimization.

These components form the foundation upon which specific customizations for day or swing trading are built.

Day trading customizations

Day trading requires bots optimized for short timeframes, typically minutes to hours, with a focus on capturing rapid price movements. These bots must process real-time data with minimal latency and execute trades at exceptional speeds to capitalize on fleeting opportunities.

For effective day trading, bots need advanced pattern recognition capabilities to identify micro-trends and short-term price reversals. They must quickly analyze technical indicators like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) calibrated for small timeframes.

Customizations should emphasize immediate risk management protocols that can instantly adjust to changing market conditions. Many successful day trading bots incorporate volatility analysis that adapts strategy parameters based on current market turbulence, becoming more conservative during erratic periods and more aggressive during stable trends.

- List of essential day trading bot features:

- Ultra-fast execution capabilities

- Micro-pattern recognition

- Volume analysis tools

- Volatility measurement

- Short-term technical indicator optimization

- Instant risk management protocols

These specialized features enable day trading bots to navigate the high-pressure environment of intraday trading, where split-second decisions can significantly impact profitability.

Strategies for day trading bots

Day trading bots excel when programmed with specific short-term strategies. Scalping techniques extract small profits from minute price changes, requiring bots to execute multiple trades with precision timing. Momentum-based approaches identify and follow short-term trends, enabling bots to ride price surges before they reverse.

Arbitrage strategies exploit price differences between exchanges, requiring bots to simultaneously monitor multiple platforms and execute synchronized trades. Technical analysis combinations for short timeframes often include moving averages crossovers on 1-5 minute charts and breakout detections using Bollinger Bands.

The most successful day trading bots combine these strategies with real-time news monitoring to adjust positions when market-moving announcements occur, providing a competitive edge in rapidly changing markets.

Swing trading customizations

Swing trading bots operate on medium timeframes spanning days to weeks, requiring different customizations than their day trading counterparts. These bots must integrate both technical analysis for entry and exit points and fundamental analysis to understand broader market trends.

Advanced trend identification mechanisms are essential, enabling bots to distinguish between genuine market shifts and temporary fluctuations. Market sentiment analysis through social media monitoring and news aggregation helps determine overall market direction and potential reversals.

Swing trading bots should feature robust backtesting capabilities across various market cycles, including bullish, bearish, and sideways periods. Position sizing algorithms typically incorporate longer holding periods and wider stop-loss parameters, accounting for the natural price oscillations that occur over multiple days.

The most sophisticated swing trading bots include correlation analysis between related assets, allowing for diversification strategies that spread risk across multiple investments with different market behaviors.

- List of essential swing trading bot features:

- Multi-factor analysis capabilities

- Trend confirmation tools

- Support and resistance detection

- Fundamental data integration

- Longer-term technical indicators

- Position sizing optimization

Strategies for swing trading bots

Effective swing trading bots employ distinct strategies suited for multi-day holding periods. Trend following methodologies identify established market directions, enabling bots to enter positions after confirming trends and exit when momentum wanes. Pullback trading approaches program bots to buy during temporary retracements in uptrends or sell during bounces in downtrends.

Breakout identification algorithms detect when prices move beyond established ranges, suggesting the beginning of new trends worth capturing. Sector rotation techniques shift investments between different market segments based on economic cycles and relative performance.

These strategies require sophisticated pattern recognition calibrated for daily and weekly charts, with emphasis on confirmation through multiple indicators rather than quick execution based on single signals, distinguishing them fundamentally from day trading approaches.

Training and backtesting considerations

Properly training and testing trading bots requires different approaches depending on the trading timeframe. Day trading bots need high-granularity historical data, often down to the minute or second, while swing trading bots can rely on daily candles for backtesting.

Both types must avoid overfitting—the danger of creating strategies too specifically tailored to historical data that fail in live markets. Forward testing, running bots with paper trading before committing real funds, provides crucial validation of strategy performance.

Performance metrics vary by trading style, with day trading focusing on high win rates and minimal drawdowns, while swing trading emphasizes larger risk-reward ratios and trend capture efficiency.

- List of backtesting elements for different trading approaches:

- Data granularity differences

- Strategy-specific performance metrics

- Risk assessment variations

- Market condition simulations

- Optimization parameters

- Reality checks and limitations

Thorough backtesting across multiple market conditions ensures bots perform consistently regardless of market volatility or directional bias, providing confidence before deployment with real capital.

Conclusion

The key to successful automated trading lies in properly customizing AI bots to match your specific trading approach. Day trading bots require speed, technical precision, and rapid execution to capitalize on fleeting opportunities, while swing trading bots need broader analytical capabilities and patience to capture extended market movements.

Post Comment

Be the first to post comment!

Related Articles

Protect Your Digital Life Without Sacrificing Speed

Apr 16, 2025 . Marketing